The integration of EPM industry and finance is gaining momentum.

The integration of EPM industry and finance is gaining

momentum. How does FONE break through the boundaries of financial digitization?

The "2021 China EPM "Integration of Industry and

Finance" Industry Research Report" recently released by iResearch

also shows that the integration of EPM industry and finance will develop

towards a centralization and lightweight direction, with emphasis on cloud

native, data system construction, and large-scale development. Comprehensive

application of all-round technologies such as data, GPU, and AI.

Traditional financial services have long ceased to be the

goal of enterprises assiduously. The accountant who was hunched, bent over,

holding a water glass, and wearing reading glasses is no longer an image

endorsement of finance.

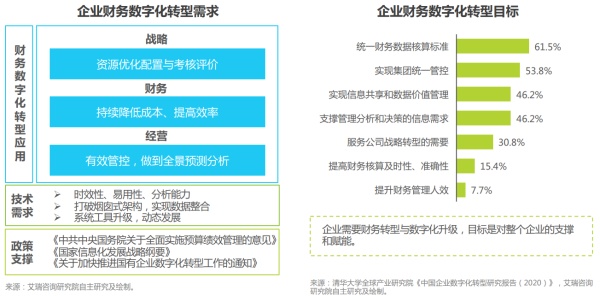

Nowadays, finance has been integrated into various business

activities of the enterprise and has become an important "dashboard"

for business managers to make business decisions. From the formulation of business

objectives, overall business planning, comprehensive budget planning, to

control during the execution process, prediction and analysis of operation and

financial indicators... With the advent of the EPM "integration of

business and finance" trend, the financial system has begun to continue to

evolve The new stage of digitalization has changed the previous state of

separation of business and financial systems, and integrated the two into a

comprehensive consideration. By strengthening the functions of the financial

department and providing forward-looking guidance for business development, the

two parties constitute a positive cycle of complementarity and complementarity.

The extension of enterprise services continues to expand,

and the integration of industry and finance has become an important direction

Looking back at the Chinese enterprise service market that

has emerged since 2013, IM, CRM, HR, expense control reimbursement, electronic

signature and other fields are the hot spots in the first half. The commonality

of these subdivisions is that they can help the relevant functional departments

of enterprises well. Optimize the work process to achieve more efficient

management.

From around 2018, with the further development of the mobile

Internet, the continuous growth of business data deposited by enterprises and

the improvement of data processing technology, enterprise customers have begun

to attach importance to the analysis capabilities of enterprise software

products. On the one hand, the main tracks of existing corporate services, such

as HR and CRM, are being transformed. For example, CRM product functions have

moved closer and closer to the core of customer relationship management from

the initial sales force management-analyzing past sales actions and strategies

To help make sales decisions.

On the other hand, new segmented products such as EPM

industry and financial integration are also emerging. Based on processes,

traditional financial systems such as bookkeeping, expense control, and reimbursement

have been relatively mature. They have helped customers realize basic digital

capabilities; and next, products that meet the needs of deeper business

analysis will become new opportunities. Among these deeper analysis and

decision-making needs, finance-related needs are obviously one of the core,

which also meets the needs of enterprises for financial digital transformation

to increasingly focus on the in-depth integration of finance and business.

It can be seen that finance has gradually transitioned from

a back-office business to a front-end business, from a feedback link to a

rehearsal link. The three most important things for an enterprise: capital

flow, information flow, and people flow, must be connected with finance, and

its role has changed from The support-oriented business has transformed into a

centralization and hub-based business. From this point of view, the market size

of the integration of industry and finance is larger than the market of pure

financial software in the past.

In the stock market, the depth and difficulty of enterprise

competition are intensifying. The market calls for a new generation of digital

tools that can improve the efficiency of enterprise operations. This trend is

breaking the boundaries between the original functional modules and levels of

the enterprise, and it is forcing the iteration of the enterprise software

ecosystem. And reorganization.

Since 2000, the integration of business and finance has been

mainly realized through the ERP system. However, the past ERP system emphasized

the use of one system to meet all needs from business to finance. This

large-scale approach puts too high requirements on the system, and the ultimate

outcome is often to reach a compromise and barely achieve business support.

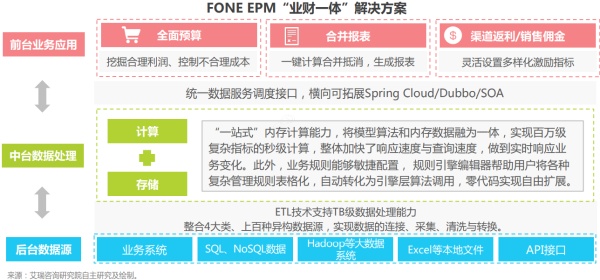

Therefore, a mature EPM industry-finance integrated system

should be composed of the integration of business systems and financial

systems. But this has brought new problems, that is, the difficulty of system

integration has increased significantly. At the same time, the business system

has departed from the financial system's constraints, which has also led to a

substantial increase in the error rate of business data. The solution is to

build a central platform.

The integration of EPM industry and finance, which is

evolving toward centralization, will assume the functions of financial rule

provision, data processing, data storage and data analysis. Because it

verifies, converts and integrates data in all business systems, financial

accounting The system and business analysis system will obtain unified and

accurate data, speeding up the speed of financial accounting and analysis.

Because the business system is no longer subject to

financial rules and does not need to process financial data too much, it can obtain

maximum flexibility and quickly meet the needs of business changes. Such a

system modular design can not only realize cross-system sharing between master

data, business data, and application modules, but can also be combined with IT

systems through component plugging and unplugging to become a more efficient

landing form.

In addition, lightweighting is also one of the important

trends of EPM "integration of industry and finance" in the future.

The local deployment of traditional financial systems may only be updated every

few years, and customers need to pay for the new version; while the lightweight

model of SaaS cloud deployment can be updated in real time, and customers can

even use the latest version without perceiving it. The advantage of this service

increases customer stickiness.

The "2021 China EPM "Integration of Industry and

Finance" Industry Research Report" recently released by iResearch

also shows that the integration of EPM industry and finance will develop

towards a centralization and lightweight direction, with emphasis on cloud

native, data system construction, and large-scale development. Comprehensive

application of all-round technologies such as data, GPU, and AI.

Platform + product + scenario How can the integration of EPM

industry and finance be more valuable?

Behind the rapid development of EPM's integration of

industry and finance, the increasingly developed business digital environment

has put forward higher requirements for data processing capabilities. For those

enterprise customers with better IT foundations and certain system replacement

costs, they will also have to Choose a lighter and more flexible system to

adapt to the rapid iterative external market and frequent business adjustments.

The lighter posture has further helped EPM's integrated

products of industry and finance to open up a wider customer source space,

allowing the customer base to expand from large enterprises to small and

medium-sized enterprises. This is a much larger "sinking market" for

corporate services. After all, the number of large group companies is limited.

According to the National Bureau of Statistics, the number of large companies

in China currently does not exceed 50,000.

EPM industry-finance integrated vendors represented by FONE

are native in the big data era and cloud environment in terms of technical

architecture, so they can respond more quickly to customer business changes and

provide a new path for corporate financial digital management. FONE focuses on

core management requirements such as comprehensive enterprise budget

management, statement consolidation, sales performance management, management

statements, etc. It can help enterprises plan business, empower finance, help

enterprise strategy implementation, and achieve the "small goal" of

reducing costs and increasing efficiency.

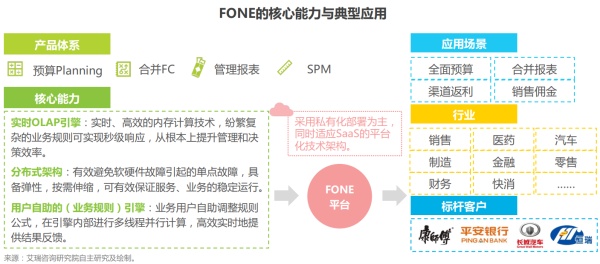

Since the establishment of the company, FONE has continued

to invest a large amount of research and development resources in product

research and development, taking product research and development as the

internal driving force of the company's long-term development, and actively

building core technical barriers. Through self-developed M-OLAP (real-time

online computing engine), FONE breaks through the performance boundaries of

traditional EPM products and meets the needs of users for real-time calculation

and agile adjustment, so that users can get better support in later use and

expansion. Based on a reliable and efficient technology platform, FONE has now

built a matrix of EPM products including FONE Planning comprehensive budget

products, FONE FC consolidated statement products, FONE SPM commission cash

back and other products.

In terms of experience, FONE strives to provide customers

with a better application and service experience, mainly from the two aspects

of direct sales and channels for continuous improvement. Introduce a more

excellent business and consultant team in direct sales to provide users with a

rich product portfolio and business services.

In terms of delivery, FONE chose to cooperate with the four

major strategic consulting agencies, head integrators, and upstream and

downstream manufacturers to launch better overall solutions to meet the

different needs of users, continuously improve the quality of software

delivery, and provide users with high quality The maintenance services of the

company truly enable software products to provide users with value.

It can be seen from the development of FONE that every step

of FONE is always closely related to the development of EPM industry and finance.

With the development of the enterprise and market changes, it is also

conducting explorations that keep pace with the times. In view of the

enterprise's new requirements for business prediction, discovery and handling

of abnormal situations, how to deal with the situation, and the agile

adjustment ability of the system, FONE's products and services emphasize the

ease of use and high performance of the product, and users can self-configure,

At the same time, it meets the performance requirements of scenes such as rapid

prediction. In addition to the introduction of new technologies such as AI

algorithms, FONE is also more deeply integrated into the overall information

architecture of the enterprise. This can be seen from the Market Place

(business financial application market) launched by FONE this year.

In order to ensure that enterprises achieve the best

experience of integrating EPM, industry and finance, FONE pays full attention

to user experience from the user's perspective, penetrates the goal of

improving corporate efficiency into products and services, and presses the

"accelerator" for enterprise business innovation. Compared with the

basic digitalization of the financial system, the EPM industry-finance

integration system that can meet the needs of business analysis and

decision-making assistance of enterprises has the opportunity to obtain excess

dividends in the wave of big data. The biggest beneficiary.

If the enterprise is regarded as an ecosystem, after the

reform of the financial department, it will bring about changes in the

surrounding environment, which will bring about changes in systems, processes,

and data, which will affect the entire enterprise and improve the effectiveness

of all departments. . Just like the butterfly effect, the financial digital

transformation led by the integration of EPM industry and finance will not only

have a profound impact on the entire industry, but also create a broader new

world for enterprises.